What Does Brave Group’s Recent ¥300 Million Funding Mean For Its Business’ Future?

The funding will strengthen Brave Group’s Web3 initiatives, further grow the company’s multiple businesses in the metaverse space,

Japanese holding company Brave Group recently announced that it has recently received a ¥300 million funding (~US$2.33 million as of this writing) from Hong Kong-based venture company Animoca Brands. Through the funding, Brave Group has accumulated a total of ¥3.04 billion in funding (~US$23.6 million as of this writing).

According to Animoca Brands’ press release, said funding will strengthen Brave Group’s Web3 initiatives, further grow the company’s multiple businesses in the metaverse space, and accelerate global expansion.

- Animoca Brands has been ramping up its Web3-centric investments, especially during the years 2021 and 2022. Some of the companies they have partnered or invested with include MyAnimeList, Billboard Indonesia, Cube Entertainment, Planet Hollywood, among others.

- The venture capital company recognizes Brave Group’s rapid adoption of Web3 innovation, including Riot Music’s Re: Volt 2022 online simultaneous live, which also saw distribution of non-fungible tokens (NFTs) based on the music of the VTuber group.

Keito Noguchi, CEO of Brave Group: “Brave Group has a proven track record of creating high-quality IPs such as virtual artists from scratch despite being latecomers to the market. Through this partnership with Animoca Brands Japan, we hope to make a strong alliance with Animoca Brands and accelerate the global expansion of our IPs and other businesses within the Web3 ecosystem.”

Kyoya Okazawa, Co-founder and Chief Investment Officer of Animoca Brands Japan: “Supporting the global expansion of great Japanese IPs is exactly the motivation that we established Animoca Brands Japan at the beginning. We share the same vision and passion for Web3 with Brave group, which led to this strategic investment opportunity.”

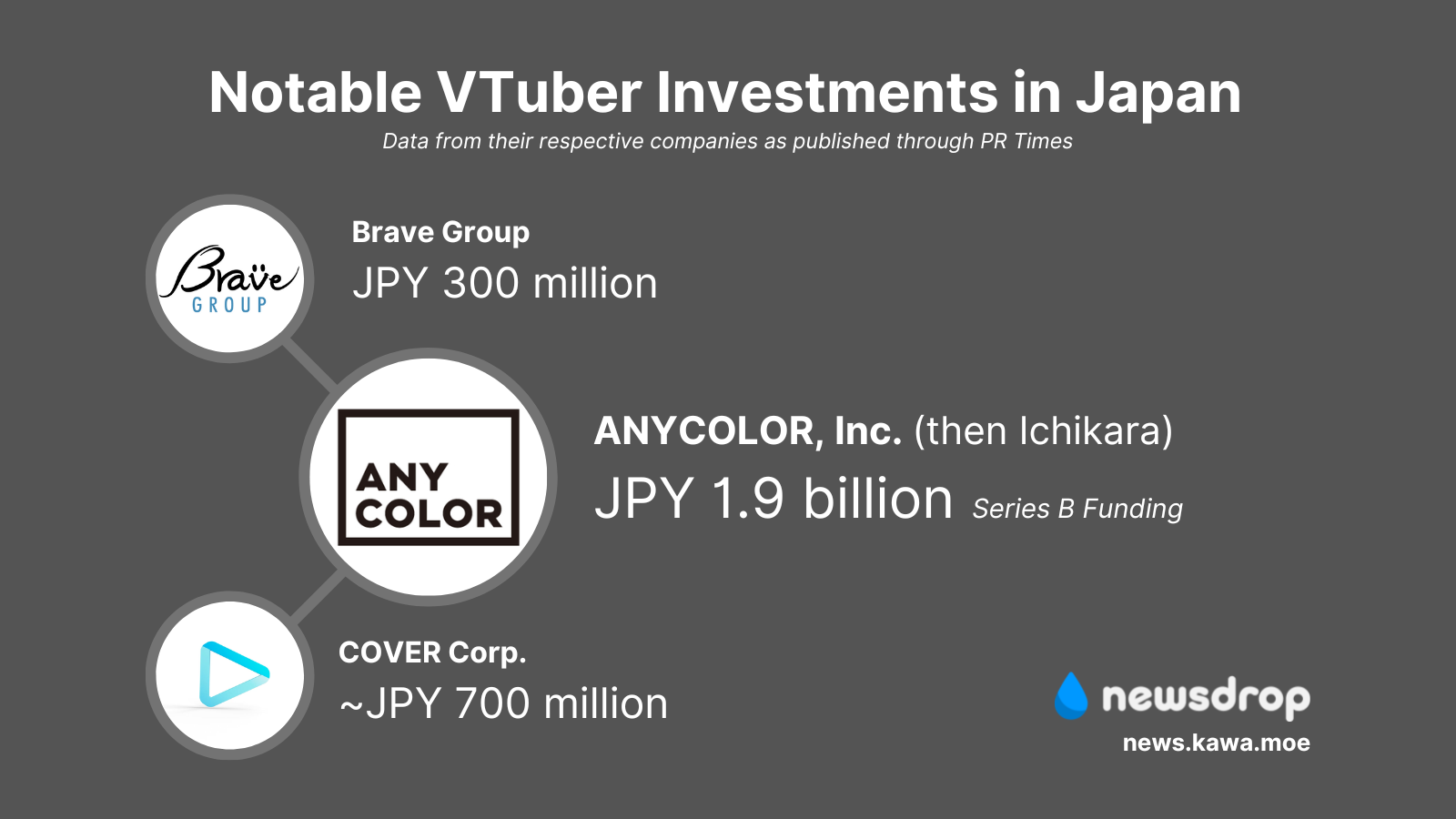

Analysis: The Brave Group Funding in the Sea of VTuber Investments

Brave Group’s funding is one of the biggest VTuber investments to date in the Japanese VTubing industry. From a business perspective, said investment is significant, considering the fact that Brave Group has multiple VTuber units, each with their own niche market. They have the music-oriented virtual idol group RIOT Music, the esports unit VSPO!, and their idol unit Palette Project.

It is also worth mentioning how the funding comes also weeks after the company recently transferred its Aogiri High School IP to ViviON. It is more likely that the IP transfer was also made in line with the funding’s objective to focus on its strongest and stable IPs yet.

From an investment perspective, it fares well to other funding rounds made by Anycolor and Cover Corporation. In 2020, Anycolor received a whopping ¥1.9 billion funding (~US$14.8 million), led by Sony Entertainment Japan, a year before it even ventured into its own VTuber business. Meanwhile, Cover Corporation raised around ¥700 million funding (~US$6.6 million), with investors including Mizuho Capital and Hakuhodo DY, the venture capital arm of Japanese advertising giant Hakuhodo.

Outside of Japan, VShojo raised around US$11 million, led by Anthos Capital, GFR Fund at Green Bay Ventures.

The Brave Group funding is a reminder for the VTubing community that the operational side of things–investment included–remains a crucial part of maintaining a VTuber business. In the past few months, we have seen agencies such as HoshiLive and Tsunderia halting operations due to operational and financial concerns. A few days ago, US-based agency TomoPulse also announced its closure, warning other agencies about the ‘harsh’ reality of maintaining an agency.

Corporate moves like these fundings are an undeniable part of the VTubing ecosystem, especially for agencies. While it is true that the industry thrives on fan purchasing power, one could not deny the reliance on external investors to properly expand their brand presence. And for Brave Group, it will always be the right choice. Diverse units require diverse strategies.